The Effect of Income Uncertainty on the Adoption of Health Insurance: A Systematic Review Study in KSA

Faisal Matar Alshalawi* and Mohammed Al-Mohaithef

Published Date: 2023-08-22Faisal Matar Alshalawi* and Mohammed Al-Mohaithef

Department of Psychology, King Faisal University, Hofuf, Saudi Arabia

- *Corresponding Author:

- Faisal Matar Alshalawi

Department of Psychology,

King Faisal University,

Hofuf,

Saudi Arabia,

Tel: 03354843020;

E-mail: Fmash48@gmail.com

Received date: June 13, 2023, Manuscript No. IPJHME-23-16986; Editor assigned date: June 16, 2023, PreQC No. IPJHME-23-16986 (PQ); Reviewed date: July 03, 2023, QC No. IPJHME-23-16986; Revised date: August 14, 2023, Manuscript No. IPJHME-23-16986 (R); Published date: August 22, 2023, DOI: 10.36648/2471-9927.9.3.103

Citation: Alshalawi FM, Al-Mohaithef M (2023) The Effect of Income Uncertainty on the Adoption of Health Insurance: A Systematic Review Study in KSA. J Health Med Econ Vol:9 No:3

Abstract

Background: People with income uncertainty confront the insurance coverage gap due to their low income or unitability income.

Objective: The objective of this research study was mainly focused on examining the effect of income uncertainty on the adoption of health insurance in reference to KSA.

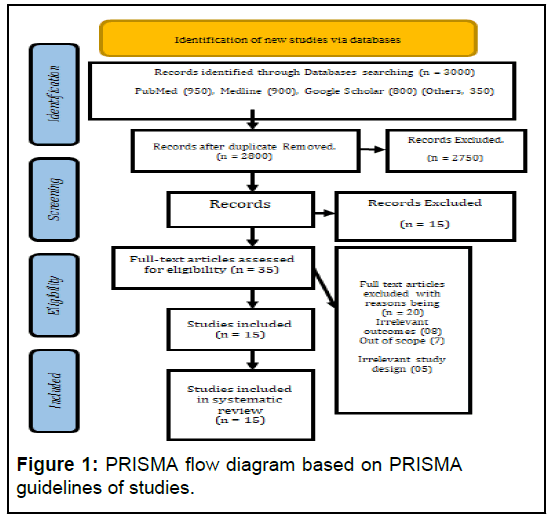

Materials and methods: This research followed a qualitative approach and was a systematic review study based on secondary databases. The secondary databases were collected through reliable search sources such as Pubmed, Medline, and Google scholar and a total of 3010 articles were selected. Further JBI assessment and PRISMA analysis were used to retrieve the most relevant articles to the topic for the systematic review. The keywords were utilized to search the articles, and then after the JBI assessment and PRISMA analysis, 15 articles were selected for the systematic review.

Results: Income uncertainty has a negative impact on the adoption of health insurance, and people with low and uncertain incomes are less likely to get health insurance coverage. The rate of health insurance adoption is high among the high income groups, and it is quite low in the income uncertainty group of people. The socio economic disparities negatively influence low income people in the accessibility to quality and equal healthcare facilities. The outcomes revealed that socio economic status influences people and people with strong financial backgrounds are more insured as compared to people with low financial backgrounds.

Conclusion: Socio economic status affects health outcomes and causes inaccessibility to basic primary medical services. However, the socio economic disparities are the root cause of the problems due to which most of the population has no access to health insurance coverage, and increasing medical costs are also the determinants of insurance coverage. Future studies can follow the quantitative approach and can collect data through primary methods for better empirical findings.

Keywords

Income uncertainty; Health insurance; Out-ofpocket expenses; Health facilities; Socio-economic factors; Universal health coverage

Introduction

In recent decades, there has been an increase in both life expectancy and mortality rate; nonetheless, socio economic differences in health have not been bridged [1]. Current researches offers abundant evidence of social gradients in health, demonstrating that those with lower socio economic beginnings have worse health, a larger chance of being ill and a shorter life expectancy than those with higher socio economic origins. Despite numerous initiatives to alleviate health inequalities, such as increased investment in health and health services as well as the adoption of health promotion programs, considerable data suggest that social class gaps in health are growing [2]. These initiatives include increasing the amount of money spent on health and health services and it should come as no surprise that a person's money, which is a primary indicator of their social status, plays such a significant role in their capacity to take care of their health. Those with greater salaries, on average, have better health and are exposed to a reduced risk of harmful health consequences than those with lower incomes. In what ways does a person's financial situation influence their health and what reasons have led to the widening of the economic difference in health that has been seen over the course of the last few decades [3].

In furthermost emerging countries, the purpose of universal health coverage is not easy to attain due to the extensive range of populations having limited access to healthcare facilities. Most people cannot afford the out of pocket expenses for insurance coverage or can pay for these services only by neglecting other urgencies [4]. Health insurance is the financial aspect that alleviates people's financial needs and provides access to health facilities related to the augmented health status [5].

People with full-time employment and work in the public sector probably have health insurance coverage. Socio economic factors such as educational attainment, poor income, and job account for the most insurance disparities among people [6]. In KSA, health insurance coverage is divided into public and private care and previous studies suggested that people with high incomes have great educational attainment and are insured. Low income people have bad health and 68% account for the uninsured, and the high income people were mostly insured with good health [7]. Sustainable Development Goals (SDG) prioritize attaining universal insurance coverage, which includes income support and a decrease in Out Of Pocket (OOP) medical expenses [8]. Micro Health Insurance (MHI) plans have arisen in countries with low incomes as a useful financial option for establishing insurance coverage [9].

Situationally heterogeneous impacts of insurance on OOP reflect on the coverage of the programs and the disparities in covered income. In the case of the Kingdom of Saudi Arabia, which operates a standard compulsory program for non-citizens, OOP often decreases with insurance while rising among wealthy people who have insurance [10]. The main determinants of health insurance registration included household income, education, media attention, religious and ethnic origin, location, and financial level. The connection with health insurance showed a large income discrepancy [11]. The lower levels of social wealth probably see a direct relationship between societal income and insurance competence. Other criteria, such as proximity to a health facility, access to transportation and job status, become increasingly significant determinants of insurance quality at stronger social income levels [12].

People with income uncertainty confront the insurance coverage gap due to their low income or unitability income [13]. Inequality may manifest itself in many ways around the globe, and not only do people in different areas of the world have extremely diverse material standards of living but there is also a large discrepancy in the health results in these various regions. Individuals living in underdeveloped countries not only have lower real wages but also have greater rates of disease and shorter life expectancies than people living in developed ones. Since there are cross-national links between income and health, the way in which we conceptualize the general uneven distribution of human flourishing should be altered [14].

The income gradient in health shows a relationship between income and health. Despite multiple contributions over the previous decade in several sectors that have found considerable correlations using data from several nations, it is still not obvious whether a positive link between wealth and health is causative. Socio economic status may affect health outcomes, and higher income households seem to be more likely to have access to and afford health care, whereas lower-income persons encounter stressful living situations that affect their health [15].

Materials and Methods

This research study used a qualitative method and focused on a comprehensive study to determine the effect of income uncertainty on adopting health insurance with a systematic review study in the Kingdom of Saudi Arabia (KSA). This systematic review provides interpretations about the influence of low income or uncertainty of income in accessing health insurance by uninsured people [16].

Study setting

This research was carried out using the qualitative methodology, the meta analysis was performed using the systematic review method, and the variable selection was determined using the JBI evaluation method. A flowchart diagram, as well as a checklist, is used to conduct an assessment based on PRISMA of the number of articles that were extracted for the study [17]. Google Scholar, PubMed, as well as Medline, were the three primary online tools that were employed to pick and extract the research that is pertinent to the investigation that is being carried out [18]. The study topic's linked keywords were used to conduct a search for the articles that were most relevant to the investigation at hand. These extracted 3000 articles cover topics including income uncertainty and its impact on the adoption of health insurance.

Inclusion criteria: The studies conducted in the last fifteen years have been included in this work. The research work based on the data analysis or based on originality has been included in this study. The conducted related to the topic and the studies conducted in the kingdom of Saudi Arabia have been preferred to be included in this study for systematic review.

Exclusion criteria: Studies that do not fulfill these requirements are not included for further processing. The studies available at the selected search engine have been included for the assessment and further for the systematic review.

Quality assessment

It is the phase in the systematic review process that is the most important. The primary objective of the JBI evaluation is to examine the methodology as well as the accuracy of the procedures that were used to identify the likelihood of bias based on the design, conduct, as well as analysis. The JBI evaluation is the essential instrument that was designed to evaluate the efficacy of the research technique and procedures. The JBI assessment has been given permission by the scientific advisory committee to conduct an investigation of the process for annexing the research activities in the systematic review.

JBI assessment and PRISMA analysis

In addition, the research papers were analyzed using the JBI evaluation and data from the most recent five years of research were retrieved for a more in depth systematic review. On the other side, PRISMA is a test with 27 components; a flowchart was used to compiles the study on KSA. The JBI evaluation considers the whole text and selected 15 studies to evaluate the income uncertainty and its impact on the adoption of health insurance. The main study was summarized in the systematic review, as well as the research aims, materials and methods were all stated clearly (Figure 1 and Table 1).

| Citations | Q1 | Q2 | Q3 | Q4 | Q5 | Q6 | Q7 | Q8 |

|---|---|---|---|---|---|---|---|---|

| Al-Hanawi, et al. | Y | U | Y | Y | Y | NA | U | Y |

| Alvarez and El-Sayed, et al. | N | Y | Y | NA | NA | Y | U | Y |

| Hemrit, et al. | Y | N | Y | U | Y | N | N | Y |

| Jaramillo and Willging, et al. | Y | U | N | Y | NA | U | Y | Y |

| Lee, et al. | N | Y | Y | Y | Y | N | Y | N |

| SEN, et al. | Y | Y | Y | NA | Y | Y | U | Y |

| Adamo and Malizia, et al. | Y | Y | NA | Y | Y | N | Y | Y |

| Bhusa and Sapkota, et al. | Y | NA | Y | U | Y | N | Y | Y |

| Olsen, et al. | N | Y | N | Y | Y | NA | N | Y |

| Zegeye, et al. | Y | U | NA | Y | Y | Y | Y | Y |

| Zweifel, et al. | Y | NA | Y | Y | Y | NA | Y | N |

| Habib and Zaidi, et al. | Y | U | Y | N | Y | Y | Y | Y |

| Finkelstein, et al. | Y | N | Y | Y | U | Y | N | Y |

| Casabianca, et al. | Y | N | Y | Y | U | Y | Y | Y |

| Han, et al. | NA | Y | Y | Y | Y | Y | Y | Y |

Table 1: Critical appraisal of included studies (Cross sectional studies).

Results

The findings of Table 2 discussed that income uncertainty negatively influences and reduces insurance coverage among people. One of the most fundamental issues with public healthcare expenditure in developing nations is the effect that uncertain economic situations around the globe have on health spending in specific regions. One of the characteristics of a globalizing world is the unpredictability of the financial system. Policymakers have been apprehensive about the impacts of economic uncertainty on both the macroeconomic and local levels, particularly in developing nations. Concern should be expressed because cutting back on public health spending due to economic uncertainty could have a severe effect on the most vulnerable people in society and reverse years' work of progress. The disparity in health outcomes has been reducing since the eighteenth century across all nations, while inequality in wealth has been growing and people who have wealth are becoming wealthier while the poor are becoming poorer. Additionally, this economic disparity reduced the level of healthcare effectiveness. Universal health coverages are not easy to accomplish due to the diverse and extensive population rate with restricted access to healthcare amenities. Most individuals either cannot finance the out of pocket health insurance expenses or are unable to pay for certain services by skipping other urgent needs [19].

The financial element of health insurance is what makes it possible for people to access medical services in relation to their improved health state. On the other hand, the mortality rate is higher in undeveloped nations and low-income people, as their quality of life is not good, along with low living standards. Due to these circumstances and uncertainty in their incomes, they are less likely to have health insurance coverage [20]. Wealth and income are the root causes of private health insurance coverage, and the likelihood of obtaining private health insurance is influenced by income. Largely wealthy individuals have a favorable influence; as a result, more income is linked to a higher likelihood of getting health insurance. In addition, those with unpredictable incomes are less likely to obtain health insurance and they are unable to access high quality healthcare facilities.

| Articles | Main idea | Place of publication | Major findings |

|---|---|---|---|

| Alvarez and El-Sayed, et al. | National income inequality and ineffective health insurance in 35 low and middle income countries. | Health policy and planning | The uncertainty in income adversely influences health insurance. |

| Adamo and AP, et al. | Uncertainty and demand for Insurance: A theoretical model of how self-control manages the optimal decision making. | Frontiers in psychology | The income uncertainty reduces the demand for health insurance. |

| Bhusal and Sapkota, et al. | Predictors of health insurance enrolment and wealth related inequality in Nepal: Evidence from Multiple Indicator Cluster Survey (MICS) | BMJ open | People with more wealth have insurance coverage in comparison to other which have low incomes and confront inequalities. |

| Zegeye, et al. | Breaking barriers to healthcare access: A multilevel analysis of individual and community level factors affecting women's access to healthcare services in Benin. | International journal of environmental research and public health | The high cost of insurance coverage and uncertainty in the incomes are the major berries towards the accessibility to healthcare and insurance. |

| Zweifel, et al. | Bridging the gap between risk and uncertainty in insurance. | The Geneva papers on risk and insurance issues and practice | The uncertainty in insurance has a direct association with income inequalities. |

| Habib and Zaidi | Exploring willingness to pay for health insurance and preferences for a benefits package from the perspective of women from low income households in Karachi, Pakistan. | BMC health services research | Low household income decreases the willingness to pay for health insurance. |

| Casabianca, et al. | Price elasticity of demand for voluntary health insurance plans in Colombia. | BMC health services research | The low prices of insurance coverages increase the demand and high cost decreases the approach to insurance. |

| Han J, et al. | Perceived value of health insurance and enrollment decision among low income population. | Innovations in pharmacy | The low income population's rate of enrollment in the insurance decision is moderately low. |

Table 2: General characteristics of included studies.

Lack of insurance exposes uninsured persons to higher risk or financial burdens due to higher medical costs. The results beyond Saudi Arabia demonstrated that the circumstantially variable effects of insurance on out of pocket expenditure have an impact on the program coverage and the differences in insured incomes. Out of pocket expenditure frequently lowers with coverage while increasing among wealthy persons who have coverage in the Kingdom of Saudi Arabia, which administers a typical compulsory program for non-citizens. Family income, employment, media exposure, ethnicity, region and financial standing were the key factors influencing health insurance enrollment. The association with health insurance revealed a significant income gap. This gap is due to the high medical costs and low wages, which are the major determinants among the people for the adoption of health insurance. The minimum wages and income and other household expenditures do not permit people to adopt insurance policies for better medical treatment; however, most of the people with a low income background are on this list and they have inaccessibility to basic healthcare needs.

Discussion

The results of most of the studies related to this topic indicated that people with income uncertainty have a negative impact on the accessibility and adoption of health insurance. Wealth and income as the underlying causes of private medical insurance and the possibility of obtaining private health insurance is influenced by wealth and high income. Largely wealthy families have a favorable influence and are more insured; as a result, more income is associated with a greater risk of getting health insurance. Because those with unpredictable incomes are less likely to have health insurance, they are unable to access high-quality medical services. People without insurance are more at risk of getting sick or having to pay more for medical care.

In addition, one's financial status and degree of health insurance are closely related and it is widely believed that there is a nonlinear relationship between the two variables because the positive impacts of more money on health insurance are more evident at low levels of income than they are at higher income levels. In all the analyzed countries, the life expectancy curve increases more quickly in people with lower income levels people than it does in higher income levels communities.

Insurance is significant and provides numerous health benefits, but its adoption is quite low among people with low economic resources. The premium expenses were excessive (38%) or, conversely, others who were financially capable and willing to pay (25%). Thus, their primary reasons for discontinuing coverage were the unstable income of informal laborer and their shifting demands. The income uncertainty concept states that current research offers abundant evidence of social gradients in health, demonstrating that those with lower socio-economic beginnings have worse health, a larger chance of being ill and a shorter life expectancy than those with higher socio-economic origins. In spite of numerous initiatives to alleviate health inequalities, such as increased investment in health and health services as well as the adoption of health promotion programs, considerable data suggest that social class gaps in health are growing.

Low income nations, economic instability has a short term negative impact on health expenditure and insurance coverage, while long term population growth lowers per capita health investment in primary health services and insurance. Economic uncertainty causes a short term boost in health spending in low income nations, but as uncertainty endures, it causes a long term decrease, whereas population growth has a negative long term effect on health spending.

In several OECD nations, this might be the situation when examining the health insurance policy phenomena in developed nations, and income becomes an important topic of interest. While people with uncertain incomes are less likely to obtain insurance because their income is not ixed and sustained. Given the importance of a healthy population in a developing country, it had become a policy priority to address the existing poor health outcomes within the context of economic crises. It is vital, prior to developing strategies for long term health inance, to understand how the effect of a rising population on healthcare expenditures. This is because there is growing evidence that a growing population can place a burden on the resources available to the government in the form of greater expenses associated with health care.

Conclusion

Income uncertainty has a negative impact on health insurance coverage. It is the accountability of the government officials to formulate the policies for the well-being of the people the low incomes. The people with low incomes are most probably the sufferers, and they confront the disparities in health insurance and care services. The responsibility of the healthcare sectors, government officials and employers are to allocate a sufficient budget for good health coverage for low-income people. Socioeconomic factors such as low income, lack of adequate resources, and education cause the inaccessibility of basic healthcare needs. Most individuals either cannot inance the out of pocket health insurance expenses or are unable to pay for certain services by skipping other urgent needs. The inancial element of health insurance is what makes it possible for people to access medical services in relation to their improved health state. However, the instability in incomes and wages is the major reason behind the unadapting of insurance among most people worldwide. The private insurances are costly enough that individuals with low income and uncertain income cannot take this, and the likelihood of private insurance is high among highincome level people.

Study Limitations

The research indings are limited to the low income uncertainty and adoption of insurance and it is restricted for the current time. The implications of this research project are only for the high authorities to consider low income people. The research study followed the systematic review and the researcher might use the primary data approach for more generalized results. This research study only targeted the uncertain income and adoption of insurance through systematic review, while future research studies can make the comparison between the low and high income people and adoption of health insurance for more clear results.

References

- Adamo M, Malizia AP (2021) Uncertainty and demand for insurance: A theoretical model of how self-control manages the optimal decision making. Front Psychol 12:700289

[Crossref] [Google Scholar] [PubMed]

- Al-Hanawi MK, Mwale ML, Qattan AMN (2021) Health insurance and out of pocket expenditure on health and medicine: Heterogeneities along income. Front Pharmacol 12:638035

[Crossref] [Google Scholar] [PubMed]

- Alvarez FN, El-Sayed AM (2016) National income inequality and ineffective health insurance in 35 low and middle income countries. Health Policy Plan 32:487-492

[Crossref] [Google Scholar] [PubMed]

- Bhusal UP, Sapkota VP (2021) Predictors of health insurance enrolment and wealth-related inequality in Nepal: Evidence from Multiple Indicator Cluster Survey (MICS) 2019. BMJ Open 11:e050922

[Crossref] [Google Scholar] [PubMed]

- Busetto L, Wick W, Gumbinger C (2020) How to use and assess qualitative research methods. Neurol Res Pract 2:1-10

[Crossref] [Google Scholar] [PubMed]

- Casabianca MS, Gallego JM, Gongora P, Rodriguez-Lesmes P (2022) Price elasticity of demand for voluntary health insurance plans in Colombia. BMC Health Serv Rese 22:618

[Crossref] [Google Scholar] [PubMed]

- Habib SS, Zaidi S (2021) Exploring willingness to pay for health insurance and preferences for a benefits package from the perspective of women from low-income households of Karachi, Pakistan. BMC Health Serv Rese 21:380

[Crossref] [Google Scholar] [PubMed]

- Han J (2018) Perceived value of health insurance and enrollment decision among low-income population. Innov Pharm 9:1-10

[Crossref] [Google Scholar] [PubMed]

- Hemrit W (2021) Does insurance demand to react to economic policy uncertainty and geopolitical risk? Evidence from Saudi Arabia. Geneva Pap Risk Insur Issues Pract 47:460-492

[Crossref] [Google Scholar] [PubMed]

- Hogan DR, Stevens GA, Hosseinpoor AR, Boerma T (2018) Monitoring universal health coverage within the Sustainable development goals: Development and baseline data for an index of essential health services. Lancet Glob Health 6:e152-e168

[Crossref] [Google Scholar] [PubMed]

- Huang X, Yoshino N (2016) Impacts of universal health coverage: Financing, income inequality, and social welfare. SSRN Elect J 33:1-38

- Iheoma CG (2022) Effect of economic uncertainty on public health expenditure in economic community of West African States: Implications for sustainable healthcare financing. Health Scie Rep 5:e678

[Crossref] [Google Scholar] [PubMed]

- Jaramillo ET, Willging CE (2021) Producing insecurity: Healthcare access, health insurance and well-being among American Indian elders. Soc Sci Med 268:113384

[Crossref] [Google Scholar] [PubMed]

- Justesen T, Freyberg J, Schultz ANO (2021) Database selection and data gathering methods in systematic reviews of qualitative research regarding diabetes mellitus an explorative study. BMC Med Res Methodol 21:94

[Crossref] [Google Scholar] [PubMed]

- Kruk ME, Gage AD, Joseph NT, Danaei G, Garcia-Saiso S, et al. (2018) Mortality due to low-quality health systems in the universal health coverage era: A systematic analysis of amenable deaths in 137 countries. The Lancet 392:2203-2212

[Crossref] [Google Scholar] [PubMed]

- Lee DC, Liang H, Shi L (2021) The convergence of racial and income disparities in health insurance coverage in the United States. Int J Equity Health 20:96

[Crossref] [Google Scholar] [PubMed]

- Muttaqien M, Setiyaningsih H, Aristianti V (2021) Why did informal sector workers stop paying for health insurance in Indonesia? Exploring enrollees’ ability and willingness to pay. PLoS One 16:e0252708

[Crossref] [Google Scholar] [PubMed]

- Pinilla J, Lopez-Valcarcel BG (2020) Income and wealth as determinants of voluntary private health insurance: Empirical evidence in Spain, 2008–2014. BMC Public Health 20:1262

[Crossref] [Google Scholar] [PubMed]

- Sen AP, Singh Y, Meiselbach MK, Eisenberg MD, Anderson GF (2022) Participation, pricing and enrollment in a health insurance “public option”: evidence from Washington State's cascade care program. Milbank Q 100:190-217

[Crossref] [Google Scholar] [PubMed]

- Zegeye B, El-Khatib Z, Ameyaw EK, Seidu AA, Ahinkorah BO, Keetile M, et al. (2021) Breaking barriers to healthcare access: A multilevel analysis of individual and community level factors affecting women’s access to healthcare services in benin. Int J Environ Res Public Health 18:750

[Crossref] [Google Scholar] [PubMed]

Open Access Journals

- Aquaculture & Veterinary Science

- Chemistry & Chemical Sciences

- Clinical Sciences

- Engineering

- General Science

- Genetics & Molecular Biology

- Health Care & Nursing

- Immunology & Microbiology

- Materials Science

- Mathematics & Physics

- Medical Sciences

- Neurology & Psychiatry

- Oncology & Cancer Science

- Pharmaceutical Sciences